Investing in multifamily properties within regions boasting strong demographic fundamentals is not just a strategy; it's a smart path to success for accredited investors. Focusing on the Sunbelt states, Rincon Partners has identified key target markets that present compelling opportunities for creating investor value through multifamily investing.

Southwest Target Markets

-

- Phoenix and Tucson, Arizona: Phoenix is the 11th largest metro area in the nation and boasts a diverse economy and a burgeoning tech industry that attracts a young, skilled workforce. Tucson continues to enjoy steady population growth, supporting a robust business climate anchored by defense and aerospace industries and the University of Arizona.

- Colorado Springs and Denver, Colorado: Colorado Springs is recognized for its defense and aerospace industries, while Denver thrives as a commercial and cultural hub. These cities are magnets for professionals and families seeking quality life, evidenced by their high population growth rates and low unemployment figures. The expanding job markets in these areas signal strong rental demand, making them attractive for multifamily investments.

-

Reno, Nevada: Traditionally known for entertainment and hospitality, Reno is rapidly diversifying with growing tech and manufacturing sectors, drawing a wide demographic range from young professionals to retirees. Coupled with no state income tax, Reno is an increasingly appealing city for many Americans.

Southeast Target Markets

- Atlanta, Georgia: Atlanta's dynamic economy, highlighted by sectors like logistics, film, and fintech, and its status as a transportation hub attracts a diverse workforce. Its population growth outpaces the national average, and the city's cultural vibrancy and educational institutions add to its multifamily investment appeal.

-

- Charlotte and Raleigh/Durham, North Carolina: Anchored by three notable universities—Duke, UNC, and NC State—Charlotte is home to a thriving financial services industry, and Raleigh/Durham's Research Triangle Park is a significant economic driver, attracting a skilled, educated workforce. These areas boast above-average population growth, driven by job opportunities and a high quality of life, signaling strong potential for multifamily investments.

-

- Charleston, Greenville, and Columbia, South Carolina; Savannah, Georgia: These cities offer a unique blend of history, culture, and economic growth. Charleston and Savannah are widely known for their ports and tourism. Greenville is home to Clemson University and a diverse economy supported by logistics, manufacturing and energy. Columbia is the state capital of South Carolina and is recognized as a hub of the healthcare industry.

-

- Nashville and Chattanooga, Tennessee: Nashville is known for its music and entertainment sectors and is home to Vanderbilt University and Nissan’s massive manufacturing facility. Fondly called the “scenic city,” Chattanooga is home to Blue Cross and a diverse logistics and manufacturing industry, including Volkswagen and GE/Roper. These cities' economic vitality and population growth rates provide a favorable backdrop for multifamily property investments.

-

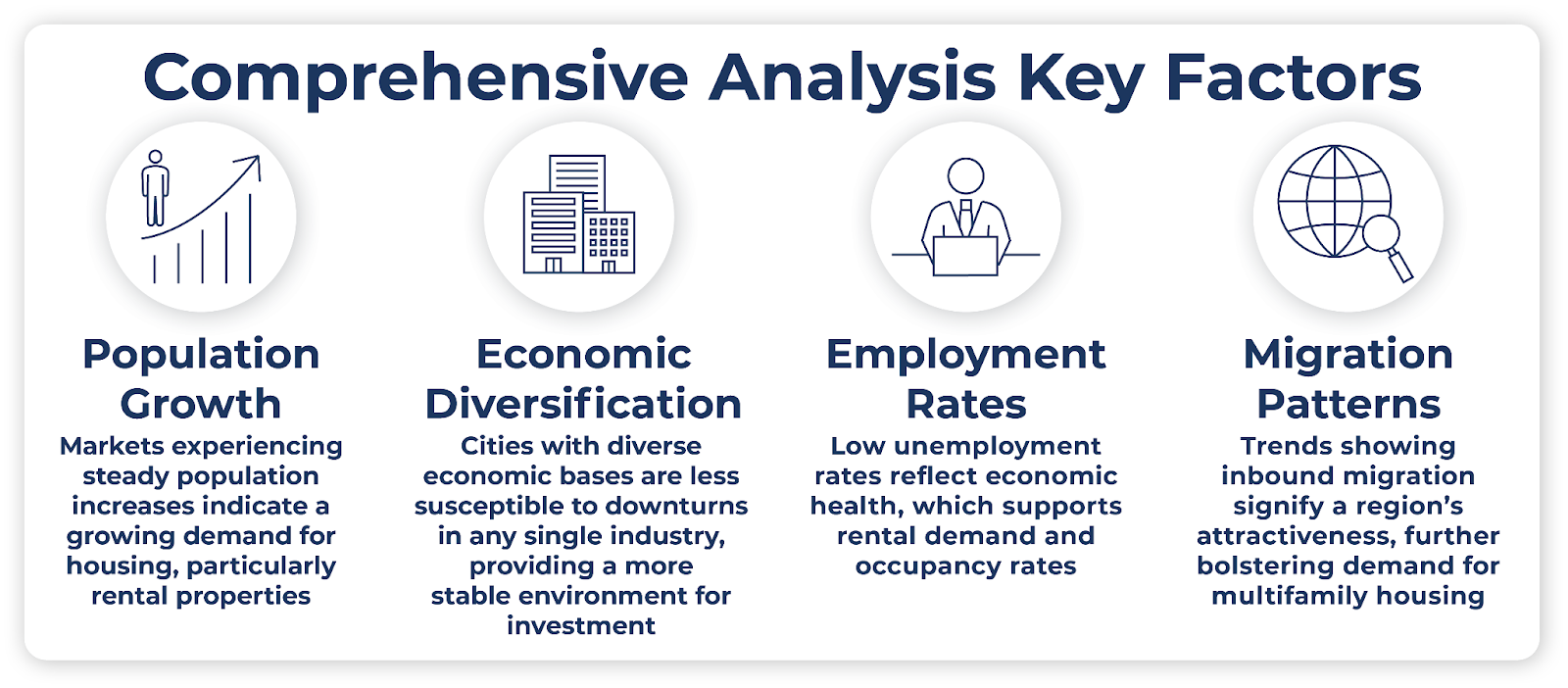

Rincon Partners identifies these target markets based on a comprehensive analysis of demographic trends, economic stability, and growth prospects. Key factors include:

Population Growth: Markets experiencing steady population increases indicate a growing demand for housing, particularly rental properties.

- Economic Diversification: Cities with diverse economic bases are less susceptible to downturns in any single industry, providing a more stable environment for investment.

- Employment Rates: Low unemployment rates reflect economic health, which supports rental demand and occupancy rates.

- Migration Patterns: Trends showing inbound migration signify a region's attractiveness, further bolstering demand for multifamily housing.

Investing in multifamily properties in these Sunbelt states, characterized by strong demographics, offers accredited investors an avenue to capitalize on the ongoing demand for rental housing. Rincon Partners' strategy focuses on these growth-oriented markets, applying its expertise in identifying properties that stand to benefit from these demographic trends.

Through strategic improvements and efficient management, Rincon aims to enhance property value to potentially benefit its investors.

The demographic strength of Rincon's target markets in the Sunbelt states lays the groundwork for multifamily investing. By aligning investment strategies with these robust demographic trends, Rincon Partners hopes to position its investors to capitalize on the growing demand for rental housing, creating opportunities for significant value creation and long-term success.

Conclusion

Accredited investors seeking to optimize their portfolios should consider strategically selecting multifamily investments in areas with strong demographics. With their favorable growth trends and economic resilience, Rincon Partners' focus on the Sunbelt states demonstrates a forward-thinking approach. As you consider your investment strategy, remember the power of demographics and the opportunities they present in the multifamily sector.