0 comments

06, May

0 comments

06, May

Multifamily investment funds have long held a central place in the portfolios of sophisticated investors, and for good reason. Their appeal lies in a combination of stable income generation, asset-backed security, and the potential for appreciation.

For investment advisors seeking to diversify client holdings beyond public equities and bonds, multifamily investments offer access to a real estate segment supported by long-term demand trends, including population growth, urbanization, and the need for affordable housing.

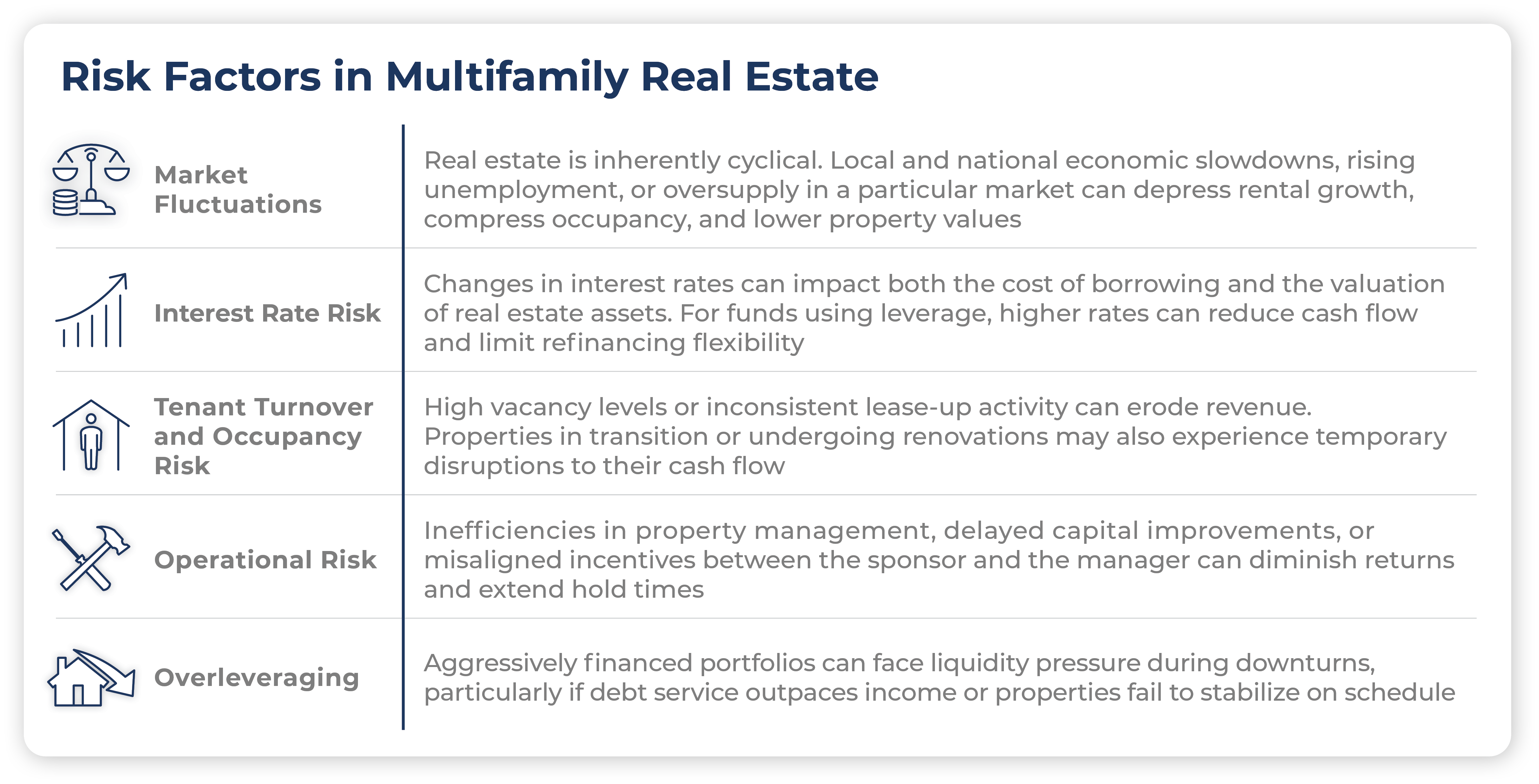

However, while the asset class offers attractive characteristics, it also comes with inherent risks—market fluctuations, interest rate volatility, and operational challenges among them. That’s why thorough risk assessment is essential. Advisors must be equipped to evaluate a fund sponsor’s approach to identifying and mitigating risk.

This article outlines the most critical risk factors associated with multifamily investment funds and highlights how Rincon Multifamily Fund II LLC serves as a model of prudent risk management.

Every investment strategy involves risk, and multifamily funds are no exception. Understanding the specific types of risk involved helps advisors perform better due diligence and align opportunities with client needs.

Rincon Multifamily Fund II LLC provides a clear example of how risk can be strategically managed through disciplined execution. Here’s how the fund addresses the key risk dimensions advisors should consider when evaluating multifamily investments.

1. Disciplined Property Identification

Rincon targets properties with strong in-place fundamentals and upside potential through light to moderate repositioning. The acquisition team prioritizes submarkets with limited new supply, robust employment drivers, and demographic momentum. Each property is evaluated for neighborhood quality, proximity to amenities, and access to major employment corridors.

2. Rigorous Underwriting

Before any acquisition, Rincon conducts in-depth underwriting that includes stress-testing assumptions on rent growth, vacancy, capital expenditures, and exit cap rates. The firm builds in conservative expectations and considers multiple economic scenarios. Importantly, the underwriting process incorporates both property-level financials and macroeconomic trends, helping ensure downside risk is understood and managed.

3. Time-Tested Investment Styles: Core Plus and Value Add

The fund leverages a dual strategy—Core Plus for income stability, and Value Add for targeted upside. Core Plus assets generate predictable cash flow with minor enhancement potential, while Value Add projects undergo thoughtful renovations designed to drive higher rents and improve tenant quality. This blended approach provides flexibility and helps balance risk across the portfolio.

4. Geographic Diversification Across High-Growth Regions

Rincon’s portfolio spans multiple metropolitan areas with long-term growth trajectories. Target markets are selected based on job creation, population influx, and favorable landlord-tenant laws. Geographic diversification reduces exposure to single-market volatility and helps ensure portfolio-level income continuity.

5. Moderate Leverage Levels

By maintaining a loan-to-value ratio between 50% and 65%, Rincon limits interest rate exposure and avoids overextension. This conservative leverage allows the fund to absorb unexpected disruptions without compromising operational stability or forcing asset sales at inopportune times.

6. Property Management Expertise (Lease-Up)

Operational execution is central to risk mitigation. Rincon employs an experienced, in-house management team with a focus on proactive leasing, tenant satisfaction, and cost control. For properties that require stabilization, the team has a strong track record of efficiently achieving lease-up goals while maintaining high occupancy quality.

7. Operational Excellence Through Property Improvements

Upgrades are targeted to produce measurable rent increases and tenant retention. Value creation is closely monitored and tied to return objectives, ensuring that capital is deployed efficiently and effectively.

For advisors evaluating multifamily funds, a key part of due diligence is assessing whether the sponsor demonstrates discipline, transparency, and operational capability. Here are three advisor-focused takeaways:

Risk is an unavoidable part of investing, but it can be managed. Rincon Multifamily Fund II LLC shows how real estate risk can be addressed through prudent practices, offering a model you can reference when evaluating other opportunities.

For a closer look at Rincon’s proven risk mitigation process, schedule a call with our team today.