0 comments

30, April

0 comments

30, April

When evaluating a multifamily real estate fund for your clients, understanding the fee structure isn’t just a matter of due diligence—it’s essential to protecting long-term returns. Fees can significantly influence overall performance, and advisors who can clearly assess and compare fee models are better equipped to align investment opportunities with their clients' goals.

This post provides a straightforward breakdown of how fee structures work in multifamily investment funds, explains how to assess their impact, and uses Rincon Multifamily Fund II LLC as an example in transparency and alignment with investor interests.

Common Fees in Multifamily Investment Funds

Most private real estate funds share a similar set of fee components. Understanding these standard fees will help you evaluate their fairness and assess how well the sponsor’s incentives align with those of investors:

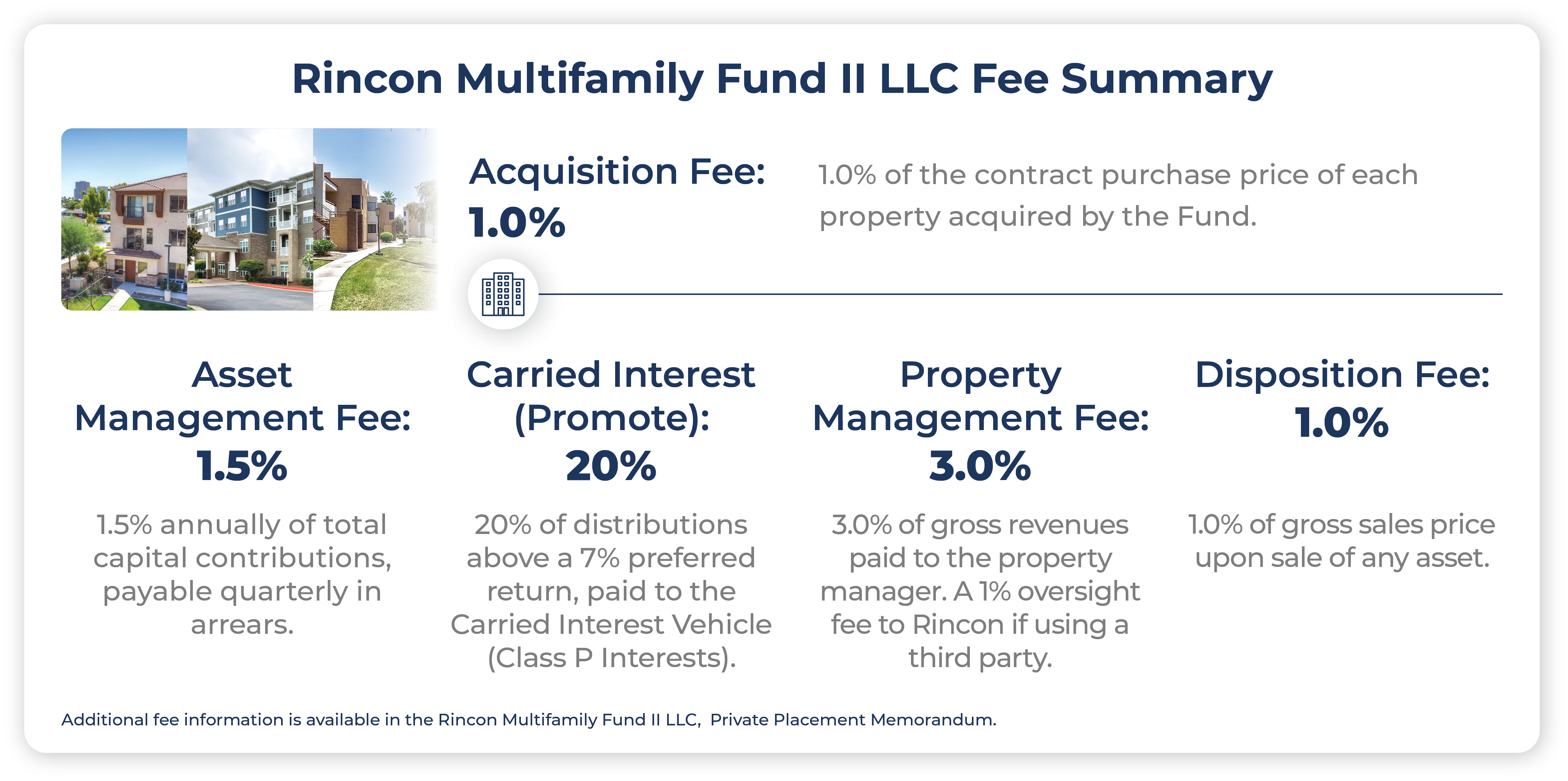

Acquisition Fee: This is a one-time fee, typically ranging from 1% to 2% of the purchase price, charged when the sponsor acquires a new property. It covers sourcing, underwriting, and due diligence.

Asset Management Fee: Typically charged as a percentage of assets under management (AUM), this fee covers the fund sponsor’s day-to-day management responsibilities. A standard range is 1% to 2%.

Performance or Promote Fee: This incentivizes the sponsor to deliver strong returns. It’s often structured as a percentage of profits (typically 20%) above a predetermined preferred return, commonly referred to as the “promote.”

Property Management Fee: Applied when securing tenants, this fee compensates property managers or third-party leasing agents. Can range from 3% to 5%, depending on whether a third-party manager is used.

Disposition Fee: Charged upon the sale of an asset, usually 1% of the sales price, to compensate the sponsor for managing the exit process.

While these fees are common, how they are structured and disclosed varies significantly across sponsors, and those differences can have a meaningful impact on net returns.

Industry Norms vs. Sponsor Alignment: What to Look For

Beyond just benchmarking fee percentages, advisors should assess how and when sponsors get paid.

A fair structure:

- Avoids layering fees in ways that erode investor profits.

Transparency and alignment are as important as the fee levels themselves. Sponsors who clearly disclose how and when fees are charged demonstrate a long-term commitment to investor trust.

Rincon’s Approach: A Case Study in Fee Transparency

Rincon Multifamily Fund II LLC is structured to provide clarity and confidence to investors. Their fee model is designed to be straightforward and competitive, in keeping with NCREIF standards and broader industry practices.

While specifics can be found in the Fund’s official documents, Rincon distinguishes itself by:

This structure helps foster confidence and trust, and ensures Rincon’s interests are aligned with long-term investor outcomes.

Conclusion: Why Fee Structure Evaluation Matters

Evaluating a fund’s fee structure is an essential component of real estate investment due diligence. Fee transparency, clarity around compensation terms, and alignment with investor interests can help advisors assess the suitability of a fund within a broader investment strategy.

Rincon Multifamily Fund II LLC provides a detailed outline of its fees, offering advisors the opportunity to understand how compensation is structured and disclosed. For more information, schedule a consultation or request detailed fund information here.

For more details on investing through FLX Networks, please contact John Feeley at tel: 908.944.7917 or via email: John.Feeley@flxnetworks.com